|

|

|

|

|

|

|

|

|

|

|

|

☐ | Fee paid previously with preliminary materials. |

☐ |

|

|

|

|

|

|

|

|

|

October 17, 2019

Dear Fellow Stockholders:

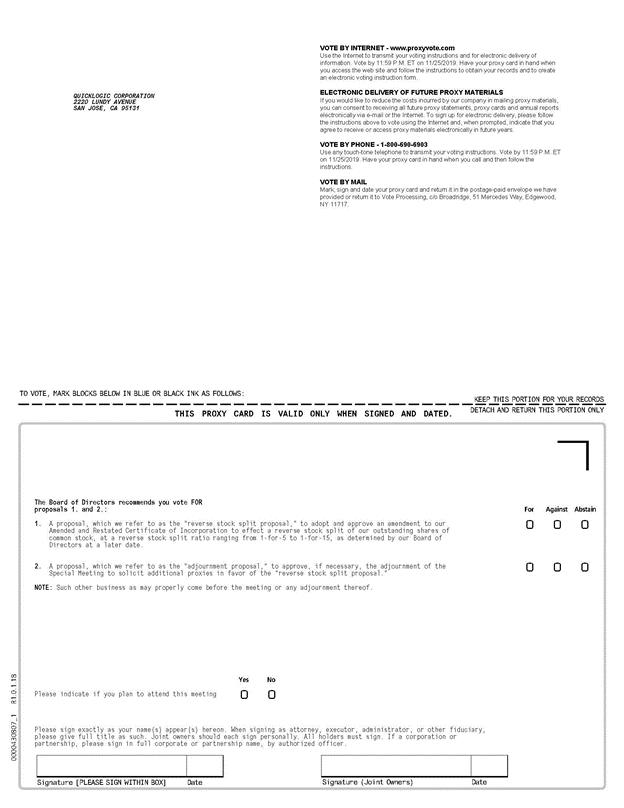

On behalf of the Board of Directors (the “Board”) of QuickLogic Corporation (“QuickLogic” or the “Company”), you are cordially invited to attend a Special Meeting of Stockholders to be held at 8:00 a.m., local time, on November 26, 2019, at the offices of Jones Day, 1755 Embarcadero Road, Palo Alto, California 94303.

At the Special Meeting, stockholders will consider and vote on a proposal to adopt and approve an amendment to our Amended and Restated Certificate of Incorporation that effects a reverse stock split of our outstanding shares of common stock, at a reverse stock split ratio ranging from 1-for-5 to 1-for-15, as determined by our Board at a later date.

The proxy statement attached to this letter provides you with information about the proposed reverse stock split amendment. Please read the entire proxy statement carefully. You may obtain additional information about the Company from documents we file with the Securities and Exchange Commission.

It is important that your shares be represented and voted at the meeting. Please vote as soon as possible even if you plan to attend the Special Meeting. We appreciate your continued ownership of QuickLogic shares and your support regarding this matter.

| |||

|

NOTICE OF SPECIALANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, NOVEMBER 26, 2019WEDNESDAY, MAY 10, 2022

The SpecialAnnual Meeting of Stockholders of QUICKLOGIC CORPORATION, a Delaware corporation (“QuickLogic” or the “Company”)Company), will be held at the offices of QuickLogic at 2220 Lundy Avenue, San Jose, CA 95131, on Tuesday November 26, 2019,May 10, 2022 at 8:10:00 a.m., local time, atfor the offices of Jones Day, 1755 Embarcadero Road, Palo Alto, California 94303.following purposes:

At this Special Meeting, or any adjournment or postponement of the Special Meeting, we plan to consider and vote upon the proposals listed below:

1. |

|

2. | To approve the amendment of the QuickLogic Corporation 2019 Stock Plan to |

3. |

|

| and |

4. |

|

Notwithstanding approval of the reverse stock split proposal by our stockholders, the Board of Directors reserves its right to elect not to proceed with implementing the reverse stock split at any time prior to the date on which the amendment to our Amended and Restated Certificate of Incorporation becomes effective pursuant the General Corporation Law of the State of Delaware (the “DGCL”), if it determines, in its sole discretion, that the reverse stock split is no longer in the best interests of the Company or its stockholders.

Only stockholders of record at the close of business on October 8, 2019 are entitled to notice of and to vote at the Special Meeting and any adjournments or postponements thereof. The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on March 14, 2022, are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof.

Your vote is important. Whether or not you plan

Again this year, we are using the U.S. Securities and Exchange Commission rule that allows companies to attend the special meeting, we hope you will vote as soon as possible. You may vote byfurnish their proxy materials over the internet or by telephone, or, if you receivedInternet. This allows us to mail our stockholders a notice instead of a paper copy of the Proxy Statement and our 2021 Annual Report on Form 10-K. The notice contains instructions on how our stockholders may access our Proxy Statement and Annual Report over the Internet and how our stockholders can receive a paper copy of our proxy materials, including the Proxy Statement, our 2021 Annual Report and a proxy card. Stockholders who do not receive a notice, including stockholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy of the proxy materials by mail you can vote by mail by completingunless they have previously requested delivery of proxy materials electronically. Employing this distribution process will help us to conserve natural resources and returningreduce the enclosedcosts of printing and distributing our proxy cardmaterials. The Proxy Statement and form of proxy are being distributed and made available on or voting instruction form. Voting over the internet, by telephone or by written proxy or voting instruction card will ensure your representation at the special meeting regardless of whether you attend in person.about March 29, 2022.

All stockholders are cordially invited to attend the Annual Meeting in person. You may revoke your proxy at any time before the vote is taken by delivering to the Secretary of QuickLogic a written revocation or a proxy with a later date (including a proxy by telephone or via the Internet) or by voting your shares in person at the Special Meeting, in which case your prior proxy would be disregarded.

For the Board of Directors, |

|

|

|

` President and Chief Executive Officer |

October 17, 2019

San Jose, California

March 29, 2022

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, WE ENCOURAGE YOU TO VOTE PROMPTLY, SO THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING.

Table of Contents

Page

QUICKLOGIC CORPORATION

PROXY STATEMENT

FOR SPECIALANNUAL MEETING OF STOCKHOLDERS

ABOUT THE SPECIALANNUAL GENERAL MEETING

General

The accompanying

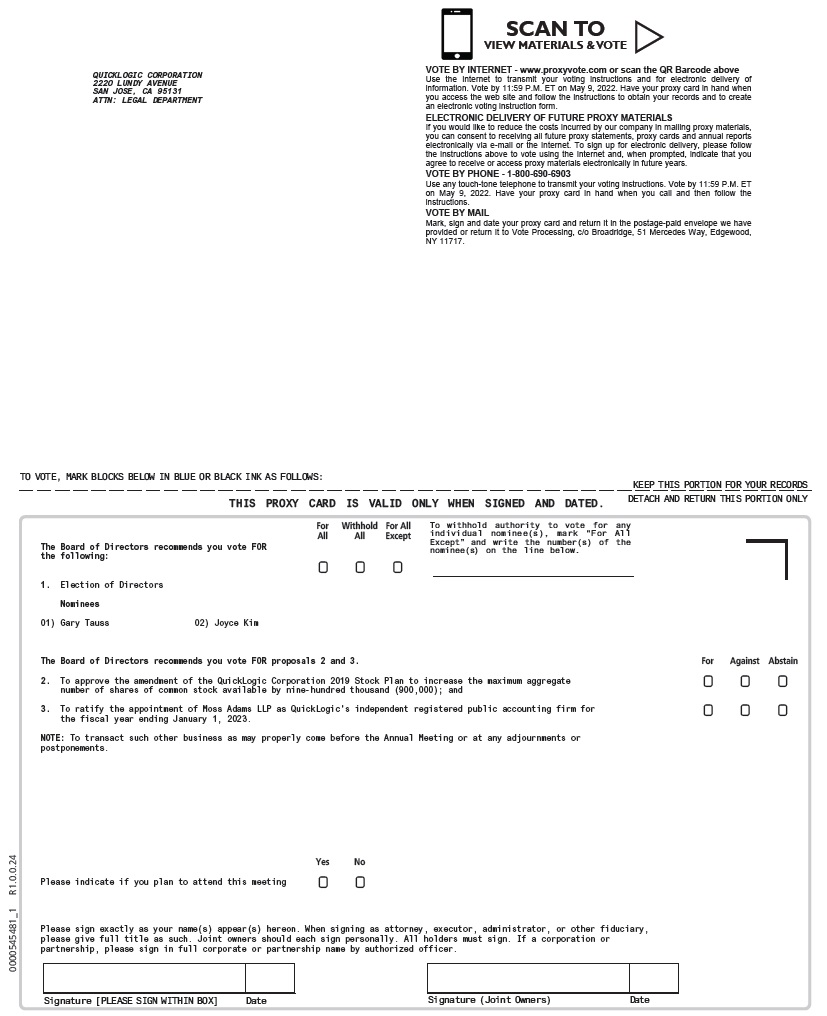

This proxy statement is solicitedfurnished by the Board of Directors of QuickLogic Corporation, a Delaware corporation (“QuickLogic” or the “Company”), in connection with the Board's solicitation of proxies for use at the SpecialAnnual Meeting of Stockholders to be held on Tuesday, November 26, 2019,May 10, 2022, at 8:10:00 a.m., local time, and at any and all adjournments or postponements thereof (the “Special“Annual Meeting”), for the purposes set forth in this Proxy Statement and in the accompanying Notice of SpecialAnnual Meeting of Stockholders.

The SpecialAnnual Meeting will be held at the offices of Jones Day, 1755 Embarcadero Road, Palo Alto, California 94303.QuickLogic at 2220 Lundy Avenue, San Jose, CA 95131, on Tuesday May 10, 2022, at 10:00 a.m., local time, and the Company's telephone number at that address is (408) 990-4000. At the SpecialAnnual Meeting, only stockholders of record at the close of business on October 8, 2019,March 14, 2021, the record date, will be entitled to vote. On October 8, 2019,March 14, 2022, QuickLogic’s outstanding capital stock consisted of 116,555,75612,362,334 shares of common stock.

At the Annual Meeting, the stockholders will be asked:

1 | To elect two Class II directors to serve for a term of three years expiring on the date on which our Annual Meeting of Stockholders is held in 2025; |

2 | To approve the amendment of the QuickLogic Corporation 2019 Stock Plan to increase the maximum aggregate number of shares of common stock available by nine hundred thousand (900,000); |

3 | To ratify the appointment of Moss Adams LLP as QuickLogic’s independent registered public accounting firm for the fiscal year ending January 21, 2023; |

4 | To transact such other business as may properly come before the Annual Meeting or at any and all adjournments or postponements thereof. |

This Proxy Statement and form of proxy statement, the foregoing notice and the accompanying proxy card arewere first being made available on or about October 17, 2019provided to all holders of our common stock, par value $0.001 per share,stockholders entitled to vote at the Special Meeting.

Purpose of the SpecialAnnual Meeting

At the Special Meeting, the stockholders will be asked on or about March 29, 2022, together with our 2021 Annual Report to consider and vote on the following proposals:Stockholders.

Board’s Recommendation

|

|

|

|

If the reverse stock split proposal is approved by the Company's stockholders at the Special Meeting, it will be effected, if at all, only upon a subsequent determination by the Board of Directors that the Reverse Stock Split is in the best interests of the Company and our stockholders at the time the reverse stock split proposal is effected. The Board of Directors may make this determination as soon as immediately following the conclusion of the Special Meeting, and the Reverse Stock Split could become effective as soon as the business day immediately following the Special Meeting.

Notwithstanding approval of the reverse stock split proposal by our stockholders, the Board of Directors reserves its right to elect not to proceed with implementing the reverse stock split proposal at any time prior to the date on which the amendment to our Amended and Restated Certificate of Incorporation becomes effective pursuant the DGCL, if it determines, in its sole discretion, that the reverse stock split proposal is no longer in the best interests of the Company or its stockholders.

Board’s Recommendation

Our Board of Directors recommends that you vote:

1 | “FOR” the election of the two nominated Class II directors; |

2 | “FOR” the approval of the amendment to the QuickLogic Corporation 2019 Stock Plan; and |

3 | “FOR” the ratification of the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 1, 2023. |

Our management does not intend to present other items of business and knows of no items of business that are likely to be brought before the Annual Meeting, except those described in this Proxy Statement. However, if any other matters should properly come before the Annual Meeting, the proxy holders will have discretionary authority to vote the shares represented by proxies in accordance with their best judgment on the matters.

1.“ FOR ” the reverse stock split; andVoting

2.“ FOR ” the adjournment proposal.

Why does Quicklogic needEach stockholder is entitled to hold this vote?

On January 18, 2019, we were notified in writing by the NASDAQ Stock Market LLC (“Nasdaq”) that the average closing bid priceone vote for each share of our common stock was belowheld on all matters presented at the criteriaAnnual Meeting. Stockholders do not have the right to cumulate votes in the election of directors. Voting instructions are included on your notice of availability of proxy materials, proxy card or voting instruction card.

Properly executed proxies received prior to the meeting, and subsequently not revoked, will be voted in accordance with the instructions on the proxy. Where no instructions are given, proxies will be voted "FOR" the election of the continued listing standardsdirector nominees described herein, “FOR” the approval of the NASDAQ Global Market, as the average per share closing price of our common stock over a consecutive 30-trading day period was less than $1.00. In the letter, the Nasdaq stated that we had an initial 180-day cure period, or until July 17, 2019, to regain compliance. In anticipation of not regaining compliance by the expiration dateamendment of the initial 180-day cure period, on July 9, 2019 we applied to transfer the listing of our common stock to the Nasdaq Capital Market, requested an additional 180 calendar days to cure the minimum bid price deficiency, and undertook to carry out a reverse stock split in order to bring our share price and average share price back above $1.00 within the additional six-month cure period, if necessary.

On July 18, 2019, we received a notification letter from the Nasdaq that our application to transfer our common stock to the Nasdaq Capital Market had been approved, and as a result, we were granted an additional 180-day grace period, or until January 13, 2020, to regain compliance with the minimum bid price requirements. In order to regain compliance, the minimum closing bid price of our common stock must be at least $1.00 per share for a minimum of 10 consecutive business days during the additional 180-day grace period. If we fail to regain compliance during this grace period, our common stock will be subject to delisting by the Nasdaq. In the letter, the Nasdaq further stated that in the event compliance cannot be demonstrated by January 13, 2020, the Nasdaq will commence suspension and delisting procedures. At that time, we may appeal the Nasdaq staff’s determination to a Hearings Panel (the “Panel”). However, we were also notified by Nasdaq that if we appeal, we will be asked to provide a plan to regain compliance to the Panel, and that historically Panels have generally viewed a near-term reverse stock split as the only definitive plan acceptable to resolve a bid price deficiency.

Our Board of Directors has determined that an amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split may be necessary to promote the continued listing of our common stock on the Nasdaq Capital Market and is in the best interests of our stockholders. If approved and implemented, the Board of Directors will select a reverse stock split ratio ranging from 1-for-5 to 1-for-15 at a later date based on various factors, including the then prevailing market conditions and the existing and expected per share trading prices of our common stock. Pursuant to the law of our state of incorporation, Delaware, our Board of Directors must adopt any amendment to our Amended and Restated Certificate of Incorporation and submit the amendment to stockholders for approval. Accordingly, our Board of Directors is requesting your proxy to vote “FOR” the reverse stock split proposalPlan and “FOR” the adjournmentratification of the appointment of the independent registered public accounting firm.

What’s required to approve each item?

Proposal 1: Election of Directors. Directors of the Company are elected by a plurality of the votes cast in contested and uncontested elections. The election at the Annual Meeting will be uncontested. “Plurality” means that the two individuals who receive the highest number of “FOR” votes will be elected as directors. You may vote either “FOR” or “WITHHOLD” your vote from any one or more of the nominees. Votes withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. If you do not instruct your broker how to vote with respect to this item, your broker may not vote your shares with respect to the election of directors. Any shares not voted by a stockholder will be treated as broker non-votes, and broker non-votes will have no effect on the results of the election of directors.

Proposal 2: Approval of Amendment of the Company's 2019 Stock Plan. The affirmative vote of a majority of the shares of common stock present (in person or by proxy) at the Annual Meeting and entitled to vote is required for the approval of the amendment of the Company's 2019 Stock Plan to increase the maximum aggregate number of shares of common stock available by nine hundred thousand (900,000). Abstentions will have the effect of a vote against the proposal and broker non-votes will have no effect.

Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm. Ratification of the appointment of Moss Adams LLP (“Moss Adams”) as the Company’s independent registered public accounting firm for the fiscal year ending January 1, 2023, will require the affirmative vote of a majority of the shares of common stock present (in person or by proxy) at the Annual Meeting and entitled to vote on the proposal. An abstention will have the effect of a vote against the ratification. Brokers will have discretionary authority to vote on Proposal 3 and, accordingly, there will be no broker non-votes for this proposal.

In addition to bringing the per share trading price of our common stock back above $1.00, we also believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional and other investors, as we have been advised that the current per share trading price of our common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers.Will my shares be voted if I do not provide my proxy?

WhatUnder applicable rules, if you hold your shares through a brokerage firm, bank or other nominee, and do not give instructions to that entity, it will still be able to vote your shares with respect to “discretionary” items, but it will not be allowed to vote your shares with respect to “non-discretionary” items. The ratification of Moss Adams as our independent registered public accounting firm (Proposal 3) is considered to be a discretionary item under applicable rules and your brokerage firm, bank, or other nominee will be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name. The remaining items of business at the difference between holdingAnnual Meeting are “non-discretionary” and if you do not instruct your broker, bank or other nominee how to vote with respect to such proposals, it may not vote with respect to these proposals and those shares will be counted as “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a stockholderbrokerage firm, bank, or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter. Please see “What’s required to approve each item?” for information regarding the vote required to approve the matters being considered at the Annual Meeting and the treatment of record and as a beneficial owner?broker non-votes.

If you hold your shares are registered directly in your name withthrough our transfer agent, American Stock Transfer &and Trust Company, LLC (“AST”),they will not be voted if you are considered the “stockholder of record” with respect to those shares.do not provide a proxy.

If your shares are held in a stock brokeragestreet name, you must bring an account statement or by aletter from your bank or other nominee, those shares are held in “street name” andbrokerage firm showing that you are considered the “beneficial owner” of the shares. As the beneficial owner of thosethe shares

you have as of the rightrecord date in order to direct your broker, bank or nominee howbe admitted to the Annual Meeting. To be able to vote your shares andheld in street name at the Annual Meeting, you will receive separate instructionsneed to obtain a legal proxy card from your broker, bank or otherthe holder of record describing how to vote your shares.record.

How can I vote my shares before the Special Meeting?

If you are a stockholder of record, you may submit a proxy by telephone,Voting Electronically via the Internet, by Telephone or by mail.Mail

There are three ways to vote by proxy:

By Internet —Stockholders who have received a notice of the availability of the proxy materials by mail may submit proxies over the Internet by following the instructions on the notice. Stockholders who have received the notice of the availability of the proxy materials by e-mail may submit proxies over the Internet by following the instructions included in the e-mail. Stockholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies over the Internet by following the instructions on the proxy card or voting instruction card.

By Telephone —Stockholders of record who live in the United States or Canada may submit proxies by telephone by calling 1-800-690-6903and following the instructions. Stockholders of record who have received a notice of availability of the proxy materials by mail must have the control number that appears on their notice available when voting. Stockholders of record who received notice of the availability of the proxy materials by e-mail must have the control number included in the e-mail available when voting. Stockholders of record who have received a proxy card by mail must have the control number that appears on their proxy card available when voting. Most of the stockholders, who are beneficial owners of their shares living in the United States or Canada and who have received a voting instruction card by mail may vote by phone by calling the number specified on the voting instruction card provided by their broker, trustee, or nominee. Those stockholders should check the voting instruction card for telephone voting availability.

By Mail —Stockholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies by completing, signing, and dating their proxy card or voting instruction card and mailing it in the accompanying pre-addressed envelope.

By casting your vote in any of the three ways listed above, you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions. You may also attend the Special Meeting and vote in person.

If your shares are held in the name of a bank, broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted. The availability of telephonic or Internet voting will depend on the bank’s or broker’s voting process. Please check with your bank or broker and follow the voting procedures your bank or broker provides to vote your shares. Also, please note that if the holder of record of your shares is a bank, broker or other nominee and you wish to vote in person at the Special Meeting, you must request a legal proxy from your bank, broker or other nominee that holds your shares and present that proxy and proof of identification at the Special Meeting; otherwise, you will not be able to vote in person at the Special Meeting.

Important Notice Regarding the Availability of Proxy Materials for Specialthe Shareholders Meeting To Be Held on May 10, 2022.

Our proxy materials including our Proxy Statement and proxy cardAnnual Report on Form 10-K are available on the Internet and may be viewed free of charge and printed at www.proxyvote.com.

Will my shares be voted if I do not provide my proxy?

If you hold your shares through our transfer agent, AST, they will not be voted if you do not provide a proxy.www.proxydocs.com/QUIK.

Under applicable rules, if you hold your shares through a brokerage firm, bank or other nominee, and do not give instructions to that entity, it will still be able to vote your shares with respect to “discretionary” items, but it will not be allowed to vote your shares with respect to “non-discretionary” items. The reverse stock split proposal (Proposal 1) and the adjournment proposal (Proposal 2) are considered "discretionary" items under applicable rules and your brokerage firm, bank or other nominee will be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name.

How will my shares be voted if I give my proxy but do not specify how my shares should be voted?

voting instructions, your shares will be voted "FOR" the reverse stock split proposal and "FOR" the adjournment proposal.

Who may attend the Special Meeting?

All stockholders are invited to attend the Special Meeting. Persons who are not stockholders may attend only if invited by the BoardTable of Directors. If you are the beneficial owner of shares held in the name of your broker, bank or other nominee, you must bring proof of ownership (e.g., a current broker's statement) in order to be admitted to the meeting. You can obtain directions to the Special Meeting by contacting our Investor Relations Department at (408) 990-4000.

Can I vote in person at the Special Meeting?

Yes. If you hold shares in your own name as a stockholder of record, you may come to the Special Meeting and cast your vote at the meeting by properly completing and submitting a ballot. If you are the beneficial owner of shares held in the name of your broker, bank or other nominee, you must first obtain a legal proxy from your broker, bank or other nominee giving you the right to vote those shares and submit that proxy along with a properly completed ballot at the meeting; otherwise, you will not be able to vote in person at the Special Meeting.

How can I change my vote?

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to our Secretary a written notice of revocation or a duly executed proxy bearing a later date, or by attending the meeting and voting in person. Your presence at the Special Meeting in and of itself is not sufficient to revoke your proxy. For shares you hold in street name, you may revoke your prior proxy by submitting new voting instructions to your broker or nominee.

ContentsWhat are the quorum and voting requirements for the proposals?

In order to take action on the proposals, a quorum, consisting of the holders of 38,851,919 shares (one-third of the aggregate number of shares of our common stock) issued and outstanding and entitled to vote as of the record date for the Special Meeting, must be present in person or by proxy. This is referred to as a “quorum.” Proxies marked “Abstain” and broker non-votes (as further discussed below) will be treated as shares that are present for purposes of determining the presence of a quorum.

The affirmative vote of the holders of a majority of the shares entitled to vote at the Special Meeting is required to adopt and approve the reverse stock split proposal.

The affirmative vote of a majority of the votes present in person or represented by proxy at the Special Meeting is required to approve the adjournment proposal.

What happens if a quorum is not present at the Special Meeting?

If the shares present in person or represented by proxy at the Special Meeting are not sufficient to constitute a quorum, the stockholders by a vote of the holders of a majority of votes present in person or represented by proxy (which may be voted by the proxyholders) may, without further notice to any stockholder (unless a new record date is set), adjourn the meeting to a different time and place to permit further solicitations of proxies sufficient to constitute a quorum.

What is an “abstention” and how would it affect the vote?

An “abstention” occurs when a stockholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions are counted as present for purposes of determining a quorum. Abstentions

with respect to the reverse stock split proposal and the adjournment proposal will have the same effect as a vote “Against” the proposals.

What is a broker “non-vote” and how would it affect the vote?

A broker non-vote occurs when a broker or other nominee who holds shares for another person does not vote on a particular proposal because that holder does not have discretionary voting power for the proposal and has not received voting instructions from the beneficial owner of the shares so the broker is unable to vote those uninstructed shares. Brokers will have discretionary voting power to vote on both proposals so we do not anticipate any broker non-votes.

Because adoption and approval of the reverse stock split proposal requires the approval of a majority of the outstanding shares, a broker non-vote will have the same effect as a vote “Against” the reverse stock split proposal.

Because approval of the adjournment proposal requires an affirmative vote of a majority of the votes present in person or represented by proxy at the Special Meeting, a broker non-vote will have no effect on the outcome of the vote with regards to the adjournment proposal.

Could other matters be decided at the Special Meeting?

Other than the reverse stock split proposal and the adjournment proposal, no other matters will be presented for action by the stockholders at the Special Meeting.

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election.

Solicitation of Proxies

We have engaged The Proxy Advisory Group, LLC, to assist in the solicitation of proxies and provide related advice and informational support, for a services fee, plus customary disbursements, which are not expected to exceed $17,500 in total. We will also reimburse brokerage firms and other custodians, nominees, and fiduciaries for their expenses in forwarding proxy and solicitation materials to stockholders.

If You

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to our secretary a written notice of revocation or a duly executed proxy bearing a later date, or by attending the meeting and voting in person. Your presence at the Annual Meeting in and of itself is not sufficient to revoke your proxy. For shares you hold in street name, you may revoke your prior proxy by submitting new voting instructions to your broker or nominee.

No Right of Appraisal

Neither Delaware law nor our amended and restated certificate of incorporation provide for appraisal or other similar rights for dissenting stockholders in connection with any of the proposals to be voted upon at the Annual Meeting. Accordingly, our stockholders will have any questionsno right to dissent and obtain payment for their shares.

Quorum; Abstentions; Broker Non-Votes

The presence at the Annual Meeting, in person or need assistanceby proxy, of the holders of at least one-third of the voting yourpower of our stock outstanding on the record date will constitute a quorum. As of the close of business on the record date, there were 12,362,334 shares of QuickLogicour common stock please contact outstanding. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum. For the purpose of determining whether the stockholders have approved matters other than the election of directors (Proposal 1), abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. Directors are elected based on a plurality of the votes cast. Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received voting instructions from their customers are counted for determining the presence or absence of a quorum for conducting business but are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved that matter.

Stockholder Nominations and Proposals for Candidates to the Board of Directors

The Proxy Advisory Group, LLC, QuickLogic’s proxy solicitor, by calling +1-212-616-2180.

+

PROPOSAL ONE

THE REVERSE STOCK SPLIT PROPOSAL

QuickLogic is asking stockholders to adoptNominating and approve a proposed amendment toCorporate Governance Committee of our Amended Restated Certificate of Incorporation to effect the Reverse Stock Split. Our Board of Directors has unanimously approvedestablished policies and declared advisable the proposed amendment, and recommends thatprocedures, available on our stockholders adopt and approve the proposed amendment. The following description of the proposed amendment is a summary and is subjectwebsite at http://www.quicklogic.com/corporate/about-us/management, to the full text of the proposed amendment, which is attachedconsider recommendations for candidates to this proxy statement as Annex A.

If stockholders approve this proposal, the Board of Directors from stockholders holding either (i) shares of the outstanding voting securities of the Company in an amount equal to at least $2,000 in market value or (ii) 1% of the Company’s outstanding voting securities continuously for at least one-year prior to the date of the submission of the recommendation. Recommendations received after the date that is 120 days prior to the one-year anniversary of the mailing of the previous year’s proxy statement will causelikely not be considered timely for consideration at that year’s annual meeting.

A stockholder that desires to recommend a candidate for election to the CertificateBoard of AmendmentDirectors must direct the recommendation in writing to the Nominating and Corporate Governance Committee, care of the Chief Financial Officer, 2220 Lundy Avenue, San Jose, California 95131, and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications and an explanation of the reasons why the stockholder believes this candidate is qualified for service on the Company’s Board of Directors. The stockholder must also provide such other information about the candidate that would be required by the Securities and Exchange Commission (“SEC”) rules to be filedincluded in a proxy statement. In addition, the stockholder must include the consent of the candidate and describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination. The stockholder must submit proof of ownership of the requisite number of Company voting securities.

A stockholder that instead desires to nominate a person directly for election to the Board of Directors must meet the deadlines and other requirements set forth in Section 2.4 of the Company’s Bylaws and the rules and regulations of the SEC.

Deadlines for Submission of Other Stockholder Proposals

Stockholders are entitled to present proposals for consideration at the next annual meeting of stockholders provided that they comply with the proxy rules promulgated by the SEC and our Bylaws.

Stockholders wishing to present a proposal for inclusion in the proxy statement relating to our 2022 Annual Meeting of Stockholders must submit such proposal to us by the date that is 120 days prior to the one-year anniversary of the date on which this proxy is first mailed, in order to be considered timely for stockholder proposals or nominations to be included in such proxy statement, which date is November 29, 2022. Proposals received after this date will likely not be considered timely for consideration at that year’s annual meeting.

Householding

Householding is a cost-saving procedure used by us and approved by the SEC. Under the householding procedure, we send only one Annual Report and Proxy Statement to stockholders of record who share the same address and last name, unless one of those stockholders notifies us that the stockholder would like a separate Annual Report and Proxy Statement. A stockholder may notify us that the stockholder would like a separate Annual Report and Proxy Statement by telephone at (408) 990-4000 or at the following mailing address: 2220 Lundy Avenue, San Jose, California 95131, Attention: Investor Relations. If we receive such notification that the stockholder wishes to receive a separate Annual Report and Proxy Statement, we will promptly deliver such Annual Report and Proxy Statement. A separate proxy card is included in the materials for each stockholder of record. If you wish to update your participation in householding, beneficial owners should contact their broker and registered shareholders should contact our transfer agent American Stock Transfer & Trust Company or AST at 1 (800) 937-5449.

ELECTION OF DIRECTORS

QuickLogic’s Board of Directors (the “Board”) is currently comprised of nine members, divided into three classes with overlapping three-year terms. As a result, a portion of our Board of Directors will be elected each year. Michael R. Farese, Andrew J. Pease, and Daniel A. Rabinovitsj have been designated as Class I directors whose terms expire at the 2024 Annual Meeting of Stockholders, Arturo Krueger, Gary H. Tauss, and Joyce Kim have been designated as Class II directors whose terms expire at the 2022 Annual Meeting of Stockholders, and Christine Russell, Brian C. Faith, and Radhika Krishnan have been designated as Class III directors whose terms expire at the 2023 Annual Meeting of Stockholders. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors. There are no family relationships between any of our directors or executive officers. Mr. Krueger has elected not to stand for reelection to the Board.

The Nominating and Governance Committee is committed to continuing to identify and recruit highly qualified director candidates with diverse experiences, perspectives, and backgrounds to join our Board. The table below provides certain information regarding the composition of our Board. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f) and related instructions.

Board Diversity Matrix As of March 14, 2022 | ||||

Total Number of Directors | ||||

Female | Male | Non-Binary | Did not Disclose Gender | |

Directors | 3 | 6 | - | - |

Demographic Information: | ||||

African American or Black | - | - | - | - |

Alaskan Native or Native American | - | - | - | - |

Asian | 2 | - | - | - |

Hispanic or Latinx | - | - | - | - |

Native Hawaiian or Pacific Islander | - | 6 | - | - |

White | - | - | - | - |

Two or More Races or Ethnicities | - | - | - | - |

LGBTQ+ | - | |||

Did not Disclose Demographic Background | 1 | |||

Nominees for Class II Directors

Two Class II directors are to be elected at this Annual Meeting of Stockholders for a three-year term ending in 2025. Pursuant to action by the Nominating and Corporate Governance Committee, the Board of Directors has nominated Garry Tauss and Joyce Kim. Unless otherwise instructed, the persons acting as proxies intend to vote proxies received by them for the election Gary Tauss and Joyce Kim. QuickLogic expects that Gary Tauss and Joyce Kim will serve if elected. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, proxies will be voted for a substitute nominee or nominees designated by the Nominating and Corporate Governance Committee of the Board of Directors. The term of office of each person elected as director will continue until such director’s term expires in 2025 or until such director’s successor has been elected and qualified or until such director’s earlier death, resignation, or removal.

Required Vote

The three nominees receiving the highest number of affirmative votes shall be elected directors. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum for the transaction of business but have no other legal effect in the election of directors under Delaware Secretarylaw.

Recommendation of the Board of Directors

QUICKLOGIC’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A

VOTE “FOR” THE CLASS I DIRECTOR NOMINEES LISTED ABOVE.

Directors and Nominees for Director

The following table sets forth information concerning the nominees for Class II director.

Nominees for Class II Director

Name | Age | Position | ||

Gary H. Tauss | 67 | Director | ||

Joyce Kim | 51 | Director |

Gary H. Tauss has been serving as a member of our Board of Directors since June 2002. Mr. Tauss has also been serving as a board member for Hootsuite Inc., a social media dashboard company since January 2010. In January 2017, Mr. Tauss joined the board of NetForecast, Inc., an auditing firm which audits ISP data usage meter systems. From January 2010 to March 2014, Mr. Tauss served as the Executive Director and Chief Executive Officer of BizTech, a not-for-profit technology-focused business incubator. From October 2006 until February 2008, Mr. Tauss served as President and Chief Executive Officer of Mobidia Technology, Inc., a provider of performance management software that enables wireless operators to provide users with high-quality mobile content. From May 2005 until the sale of its assets to Transaction Network Services, Inc. in March 2006, Mr. Tauss served as President, Chief Executive Officer and director of InfiniRoute Networks Inc., a provider of software peering services for wireline and wireless carriers. From October 2002 until April 2005, Mr. Tauss served as President and Chief Executive Officer of LongBoard, Inc., a company specializing in fixed-to-mobile convergence application software for leading carriers and service providers. From August 1998 until June 2002, Mr. Tauss was President, Chief Executive Officer, and a director of TollBridge Technologies, Inc., a developer of voice-over-broadband products. Prior to co-founding TollBridge, Mr. Tauss was Vice President and General Manager of Ramp Networks, Inc., a provider of Internet security and broadband access products, with responsibility for engineering, customer support and marketing. Mr. Tauss earned both a B.S. and an M.B.A. degree from the University of Illinois. Mr. Tauss has a strong executive background with technology companies providing products for the mobile market. His in-depth understanding of the important attributes of products for the mobile market make him an invaluable resource as QuickLogic develops and markets devices for the mobile market.

Joyce Kim brings over two decades of experience scaling commercial innovation and growth in the technology sector through large scale digital transformation and brand elevation strategies. Her expertise spans all facets of Go-To-Market including digital, brand, communications, channels and product strategy for global hardware and SaaS companies.

Currently, she serves as the Chief Marketing Officer for Genesys, PE backed pre-IPO company with over $2B in revenue and is responsible for driving market expansion and revenue diversification strategies including customer acquisition, engagement and channel growth. From 2016 to 2020, she was Chief Digital & Marketing Officer for Arm, where she led the enterprise-wide digital transformation and digital GTM strategy for new SaaS and IoT platform. Ms. Kim also successfully launched multiple microprocessor IP products in Japan and China alongside one of the largest partner ecosystems in the world. Prior to Arm, Ms. Kim was at Citrix from 2015 to 2016 as the Chief Marketing Officer. From 2008 to 2015 she led marketing for global brands such as Skype and Skype for Business at Microsoft as well as product communications and partnerships for Chromebooks and WebRTC/Google Hangouts at Google. From 2000 to 2007, she held multiple marketing and product management leadership positions for several startup and mid-sized companies including Wrike, Symmetricom, and Internap.

The Company believes that Ms. Kim's expertise in increasing brand value and revenue growth, by advancing a data-driven organization, will add significant value to her role. She has demonstrated her thought leadership as an active member of the CMO Council, Executive Council Member of the Forbes CMO Practice, McKinsey CMO Advisory Council, and as part of the Fast Company Executive Board. She also serves as a member of the board of directors at Bring Me A Book, a non-profit focused on bringing the joy and transformational power of books to all children in under-resourced communities. She also serves as an advisory board member for Sparklabs Frontier program at Arizona State University.

Ms. Kim earned a double major from California Polytechnic State University San Luis Obispo with Bachelor of Science degrees in Finance and effectArchitecture.

Incumbent Class I Directors Whose Terms Expire in 2024

| Name | Age | Position | ||

| Michael R. Farese | 75 | Chairman of the Board | ||

| Andrew J. Pease | 71 | Director | ||

| Daniel A. Rabinovitsj | 57 | Director |

Michael R. Farese (Ph.D.) has been serving as a member of our Board of Directors since April 2008, and as our Chairman since December 6, 2019. Dr. Farese also served as Chairman of the Reverse Stock Split only ifNominating and Corporate Governance Committee from August 2014 until February 2021. In January 2015, Dr. Farese joined Antenna79, a consumer electronics company creating advanced antenna technology for wireless devices, where he held the position of Chief Scientist until December 2016 when Antenna79 was acquired. From June 2010 to December 2014, Dr. Farese served as Chief Technology Officer and Senior Vice President of Global Engineering at Entropic Communications Inc., a fabless semiconductor company that designs, develops and markets system solutions to enable connected home entertainment. From September 2007 to May 2010, he was President and Chief Executive Officer and member of the Board of Directors of BitWave Semiconductor, Inc., a fabless semiconductor company and innovator of programmable radio frequency ICs. From September 2005 to September 2007, Dr. Farese was Senior Vice President, Engineering, of Palm, Inc., a leading mobile products company. Dr. Farese also served as President and Chief Executive Officer of WJ Communications, a radio frequency (RF) semiconductor company, from March 2002 to July 2005 and President and CEO of Tropian Inc., a developer of high efficiency RF ASICs for 2.5 and 3G cellular phones, from October 1999 to March 2002. Prior to that time, Dr. Farese held senior management positions at Motorola Corp., Ericsson Inc., Nokia Corp. and ITT Corp. Dr. Farese also held management positions at AT&T Corp. and Bell Laboratories, Inc. and has been in the telecommunications and semiconductor industry for more than 40 years. Dr. Farese also served on the board of PMC-Sierra, Inc., an Internet infrastructure semiconductor solution provider, from May 2006 until its acquisition in January 2016 by Microsemi Corp. Dr. Farese holds a B.S. degree and a Ph.D. in Electrical Engineering from Rensselaer Polytechnic Institute. He also received his M.S. degree in Engineering from Princeton University. Dr. Farese has extensive executive experience and knowledge of the wireless industry, cellular handsets and wireless devices, and the use of semiconductors for the wireless industry. His business acumen and strong technical and strategic planning skills bring an invaluable perspective to the Board.

Andrew J. Pease has been serving as a member of our Board of Directors since April 2011 and Chairman of the Nominating and Corporate Governance Committee since February 2021. He joined QuickLogic in November 2006 and served as our President and Chief Executive Officer from January 2011 to his retirement in June 2016, and as our President from March 2009 to his retirement in June 2016. From November 2006 to March 2009, Mr. Pease served as our Vice President of Worldwide Sales. From July 2003 to June 2006, Mr. Pease was Senior Vice President of Worldwide Sales at Broadcom Corporation, a global leader in semiconductors for wired and wireless communications. From March 2000 to July 2003, Mr. Pease was Vice President of Sales at Syntricity, Inc., a company providing software and services to better manage semiconductor production yields and improve design-to-production processes. From 1984 to 1996, Mr. Pease served in a number of sales positions at Advanced Micro Devices, or AMD, a global semiconductor manufacturer, where his last assignment was Group Director, Worldwide Headquarters Sales and Operations. Mr. Pease previously held Vice President of Sales positions at Integrated Systems Inc., an embedded software manufacturer (1996-1997), and Vantis Corporation, a programmable logic subsidiary of AMD (1997-1999). Mr. Pease holds a B.S. degree from the United States Naval Academy and an M.S. in computer science from the Naval Postgraduate School in Monterey, California. Mr. Pease has many years of executive experience in the semiconductor industry, primarily in sales and operations. His vast understanding of the semiconductor industry coupled with his in-depth knowledge of the day-to-day operation and strategic direction of the Company makes him an invaluable resource and contributor to the Board

Daniel A. Rabinovitsj has been serving as a member of our Board of Directors since October 2014. In August 2018, Mr. Rabinovitsj joined Facebook, a social networking company. From April 2018, he has been serving as board member in NanoSemi, Inc. a startup company, which develops intellectual property based upon machine learning to improve communication and other systems. Mr. Rabinovitsj served as Chief Operating Officer of Ruckus Wireless, Inc., a global supplier of advanced wireless systems for the mobile Internet infrastructure market, from October 2014 until its acquisition by ARRIS International plc in December 2017. Mr. Rabinovitsj served as President of ARRIS International plc. From 2011 to September 2014, Mr. Rabinovitsj served as Senior Vice President of Qualcomm Atheros, Inc.’s wired and wireless networking and small cell infrastructure business. Prior to Qualcomm Atheros, Mr. Rabinovitsj served in a number of executive management positions at companies including Atheros Communications, NXP Semiconductors, ST Ericsson, and Silicon Labs. Mr. Rabinovitsj received an M.A. in Asian Studies and a B.A. in Philosophy from the University of Texas at Austin. Mr. Rabinovitsj has over twenty-five years of experience in the semiconductor industry where he has spent considerable time focusing on communications and networking. Drawing from his extensive background, he is able to provide invaluable insights into the mobile market, the Company’s focused market. These insights coupled with his international business experience make Mr. Rabinovitsj a significant and respected contributor to the Board.

Incumbent Class II Directors Whose Terms Expire in 2022

Name | Age | Position | ||

| Arturo Kruger | 82 | Director | ||

Gary Tauss | 67 | Director | ||

Joyce Kim | 51 | Director |

Incumbent Class III Directors Whose Terms Expire in 2023

Name | Age | Position | ||

Christine Russell | 72 | Director | ||

Brian C. Faith | 47 | Director | ||

| Radhika Krishnan | 51 | Director |

Christine Russell has been serving as a member of our Board of Directors since June 2005. On December 23, 2019, Ms. Russell was elected as member of the Board of Directors of AXT, Inc. From July 2018 to March 2020, Ms. Russell was Chief Financial Officer at PDF Solutions, which offers yield process improvement and manufacturing efficiencies to the semiconductor industry and their supply chain using proprietary AI and data mining software technology. In February 2017, she became a member of the Board of Directors of eGain Corporation, a Nasdaq traded SaaS company providing software for call center and customer support organizations. From May 2015 through March 2018, she served as Chief Financial Officer at UniPixel, Inc., a precision engineered film company whose products include touch-screen films. From May 2014 to March 2015, Ms. Russell served as Chief Financial Officer of Vendavo, Inc., a pricing optimization enterprise software company, which was sold in late 2014 to a private equity firm. From May 2009 to October 2013, Ms. Russell was Chief Financial Officer of Evans Analytical Group (EAG), a leading international provider of materials characterization and microelectronic failure analysis and “release to production” services. From June 2006 to April 2009, Ms. Russell was at Virage Logic Corporation, a provider of advanced intellectual property for the design of integrated circuits, where she served as Executive Vice President of Business Development from September 2008 and as Vice President and Chief Financial Officer from June 2006 to September 2008. Ms. Russell served as Senior Vice President and Chief Financial Officer of OuterBay Technologies, Inc., a privately held software company enabling information lifecycle management for enterprise applications, from May 2005 until February 2006, when OuterBay was acquired by Hewlett-Packard Company. From October 2003 to May 2005, Ms. Russell served as the Chief Financial Officer of Ceva, Inc., a company specializing in semiconductor intellectual property offering digital signal processing cores and application software. Prior to 2005, Ms. Russell served as Chief Financial Officer and in various senior financial management positions with a number of technology companies for a period of more than twenty years. Ms. Russell holds a B.A. degree and an M.B.A. degree from the University of Santa Clara.

Ms. Russell’s extensive executive experience in corporate finance, accounting and operations, and her involvement in governance issues for boards of directors in her role as Chairman Emeritus of the SVDX (Silicon Valley Directors Exchange), an organization that fosters excellence in corporate governance for directors in affiliation with Stanford University and past service as President of the NACD, Silicon Valley Chapter, make her an important asset to the Company. In addition, her career background in semiconductor intellectual property companies provides her with specific industry knowledge.

Brian C. Faith was promoted to Chief Executive Officer and was elected as a director in June 2016 after having served as Vice President of Worldwide Marketing and Vice President of Worldwide Sales & Marketing between 2008 and 2016. Mr. Faith has been with QuickLogic since 1996, and during the last 20 years has held a variety of managerial and executive leadership positions in engineering, product line management, marketing, and sales. Mr. Faith has also served as the Chairman of the Marketing Committee for the CE-ATA Organization. He holds a B.S. degree in Computer Engineering from Santa Clara University and was an Adjunct Lecturer at Santa Clara University for Programmable Logic courses.

Mr. Faith’s vast understanding of the semiconductor industry coupled with his in-depth knowledge of the day-to-day operation and strategic direction of the Company makes him an invaluable resource and contributor to the Board.

Radhika Krishnan is a versatile product and general management executive with a strong track record of building new businesses at both startups and Fortune 500 companies. Her prior accomplishments and success is based on a combination of deep technical expertise and business acumen, as well as hands-on experience across engineering, QA, product management, messaging, go to market and ecosystem building. The Company believes her experience across multiple facets of the cloud infrastructure, gained from working with best-in-class providers, will allow her to create practical and winning customer solutions.

Ms. Krishnan currently serves as Chief Product Officer and General Manager at Hitachi Vantara. She is responsible for the vision, strategy, delivery, positioning, and P&Ls for all Hitachi Vantara products, including highly resilient data storage, multi-cloud solutions, and the industry leading Lumada SaaS portfolio across the data management, analytics, AI/ML, and Industrial IoT market segments. Prior to joining Hitachi Vantara, Krishnan served as the Executive Vice President and General Manager of Software at 3D Systems Corporation from 2019 to 2020. From 2018 to 2020, Ms. Krishnan was Vice President and General Manager of software defined infrastructure at Lenovo. Previously, she was Vice President, Solutions and Product Alliances at Nimble Storage from 2013 to 2018. At Network Appliance she was a Product Manager from 2009 to 2013 having previously been at Cisco Systems as an Interconnect and Switches Product Manager for one year. She started her career at Hewlett Packard, Co where she had various Senior Management roles from 1998 to 2008.

Ms. Krishnan holds a bachelor's degree in Electrical and Electronics Engineering from Birla Institute of Technology and Science, Pilani and an MBA from San Jose State University.

Board Leadership Structure; Lead Independent Director

The Board of Directors does not currently have a policy on whether the roles of Chief Executive Officer and Chairman may be filled by one individual. This allows the Board flexibility to better address the leadership needs of the Company from time to time as it deems appropriate. We currently separate the positions of Chief Executive Officer and Chairman of the Board. Mr. Brian C. Faith is our President and Chief Executive Officer and Dr. Farese has served as our non-employee Chairman of the Board since December 6, 2019.

Board’s Oversight of Risk Management

The Board has an active role, as a whole and at the committee level, in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s credit, liquidity, operations, and enterprise risks. The Company’s Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Audit Committee oversees management of financial, accounting, and internal control risks. The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board of Directors and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks. The Board and its committees are committed to ensuring effective risk management oversight and work with management to ensure that effective risk management strategies are incorporated into the Company’s culture and day-to-day business operations.

Board Meetings, Committees and Corporate Governance

The Board of Directors has determined that the Company’s current directors, with the exception of Mr. Faith, meet the independence requirements of the Nasdaq Capital Market. No director qualifies as independent unless the Board of Directors determines that the Reverse Stock Split would bedirector has no direct or indirect material relationship with the Company. In making the determination that a particular director is independent, the Board considers the relationships that such director has with the Company and all other facts and circumstances deemed relevant in determining their independence, including information requested from and provided by each director concerning his or her background, employment, and affiliations, including family relationships and other information received through annual directors’ questionnaires.

It is the best interestspolicy of QuickLogicthe Board of Directors to have a separate meeting time for independent directors. During the last fiscal year, five sessions of the independent directors were held.

The standing committees of the Board of Directors include an Audit Committee, a Compensation Committee, and its stockholders.a Nominating and Corporate Governance Committee.

We have written charters for the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee, copies of which are available on our website, free of charge, at http://www.quicklogic.com/corporate/about-us/management. You can also obtain copies of the charters, free of charge, by writing to us at 2220 Lundy Avenue, San Jose, California 95131, Attention: Finance Department.

In accordance with applicable SEC requirements and Nasdaq Capital Market listing standards, all the standing committees are comprised solely of non-employee, independent directors. The Reverse Stock Split could becometable below shows current membership for each of the standing committees.

Audit | Nominating and Corporate | Compensation | ||

Christine Russell (1)(2) | Andrew J. Pease (1)(4) | Gary H. Tauss (1) | ||

Michael R. Farese (3) | Arturo Krueger (5) | Michael R. Farese | ||

Arturo Krueger (5) | Daniel A. Rabinovitsj | Daniel A. Rabinovitsj | ||

Joyce Kim | Christine Russell | Christine Russell | ||

Mike Farese | Radhika Krishnan | |||

Joyce Kim | ||||

Radhika Krishnan | ||||

Gary H. Tauss |

(1) | Committee Chairman |

(2) | Audit Committee Financial Expert |

(3) | Lead Independent Director |

| (4) | Mr. Pease assumed the position of Nominating and Corporate Governance Committee Chair, previously held by Dr. Farese, effective February 10, 2021. |

| (5) | Mr. Krueger has decided not to stand for reelection to the Board. |

Audit Committee

The Audit Committee held five meetings in 2021. Ms. Russell has served as soonChairman of the Audit Committee since April 2006. Dr. Farese and Mr. Krueger have served as members of the business day immediately followingAudit Committee since February 2010, and Ms. Kim has served since December 2021. Each member meets the Special Meeting.independence requirements of the SEC and the Nasdaq Capital Market. The Board of Directors also may determine in its discretion not to effect the Reverse Stock Split and not to file the Certificatehas determined that Ms. Russell is an Audit Committee Financial Expert as defined by Item 407(d)(5) of Amendment. No further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split.Regulation S-K.

The proposed amendment, if effected,Audit Committee has sole and direct authority to select, evaluate and compensate our independent registered public accounting firm, and it reviews and approves in advance all audit, audit related and non-audit services, and the related fees, provided by the independent registered public accounting firm (to the extent those services are permitted by the Securities Exchange Act of 1934, as amended). The Audit Committee meets with our management and appropriate financial personnel regularly to consider the adequacy of our internal controls and financial reporting process and the reliability of our financial reports to the public. The Audit Committee also meets with the independent registered public accounting firm regarding these matters. The Audit Committee has established a Financial Information Integrity Policy, pursuant to which QuickLogic can receive, retain and treat employee complaints concerning questionable accounting, internal control or auditing matters, or the reporting of fraudulent financial information. The Audit Committee examines the independence and performance of our independent registered public accounting firm. In addition, among its other responsibilities, the Audit Committee reviews our critical accounting policies, our annual and quarterly reports on Forms 10-K and 10-Q, and our earnings releases before they are published. The Audit Committee has a written charter, a copy of which is available on our website, free of charge, at http://www.quicklogic.com/corporate/about-us/management.

Compensation Committee

The Compensation Committee held four meetings in 2021 and acted by unanimous written consent two times during the year. Mr. Tauss has served as Chairman of the Compensation Committee since September 2004. Ms. Russell, Dr. Farese and Mr. Rabinovitsj have served as members of the Compensation Committee since February 2010, August 2014, and January 2015, respectively. Ms. Krishnan has served since November 2021. Each member of the Compensation Committee meets the independence requirements of the SEC and the Nasdaq Capital Market. The purpose of the Compensation Committee is to: (i) discharge the responsibilities of the Board of Directors relating to compensation of the Company’s directors, Chief Executive Officer, and executive officers; (ii) review and recommend to the Board of Directors compensation plans, policies and benefit programs, as well as approve individual executive officer compensation packages; and (iii) review and discuss the Compensation Discussion and Analysis with management and prepare the Compensation Committee Report to be included in the Company’s Proxy Statement and Annual Report on Form 10-K. The Compensation Committee’s duties also include administering QuickLogic’s stock option plans and employee stock purchase plans.

The Compensation Committee has the authority to retain and meet privately with independent advisors and compensation and benefits specialists as needed, and may request the assistance of any director, officer or employee of the Company whose advice and counsel are sought by the Compensation Committee. The Compensation Committee has periodically engaged Compensia as an independent compensation consultant, including in 2021. The Compensation Committee has reviewed the independence of Compensia under applicable SEC and Nasdaq standards and found that no conflict of interest exists. The Compensation Committee, after reviewing management’s recommendations, determines the equity and non-equity compensation of the Company’s executive officers and directors. Management generally provides internal compensation information, compensation survey information for similarly sized technology companies, and other information to the Compensation Committee, and the Chief Executive Officer recommends compensation amounts for the executive officers other than the Chief Executive Officer. Under the guidance of the Compensation Committee, the Chief Executive Officer or an executive officer of the Company makes recommendations to the Compensation Committee regarding the executive incentive compensation plan, including plan objectives and payments earned based on performance to those objectives. No members of management are present when the Compensation Committee approves the compensation of the executive officers.The Compensation Committee may delegate its responsibilities to subcommittees when appropriate. The Compensation Committee has a written charter, which is available on our website, free of charge, at http://www.quicklogic.com/corporate/about-us/management.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee held three meetings in 2021. Dr. Farese previously served as Chairman of the Nominating and Corporate Governance Committee from August 2014 to February 2021. On February 10, 2021, the Board of Directors approved the slate of committee members and chairpersons, which includes the appointment of Mr. Pease as the Chairman of the Nominating and Corporate Governance Committee. Each of the directors on the Nominating and Corporate Governance Committee meets the independence requirements of the SEC and the Nasdaq Capital Market. The purpose of the Nominating and Corporate Governance Committee is to: (i) assist the Board of Directors by identifying, evaluating and recommending to the Board of Directors, or approving as appropriate, individuals qualified to be directors of QuickLogic for either appointment to the Board of Directors or to stand for election at a meeting of the stockholders; (ii) review the composition and evaluate the performance of the Board of Directors; (iii) review the composition and evaluate the performance of the committees of the Board of Directors; (iv) recommend persons to be members of the committees of the Board of Directors; (v) review conflicts of interest of members of the Board of Directors and executive officers; and (vi) review and recommend corporate governance principles to the Board of Directors. Other duties of the Nominating and Corporate Governance Committee include overseeing the evaluation of management, succession planning, and reviewing and monitoring the Company’s Code of Conduct and Ethics. The Nominating and Corporate Governance Committee adopted our Corporate Governance Guidelines in December 2004. Ms. Krishnan and Ms. Kim each joined the Nominating and Corporate Governance Committee on November 2021 and December 2021 respectively. A copy of the Guidelines and a copy of the written charter of the Nominating and Corporate Governance Committee are available on our website, free of charge, at http://www.quicklogic.com/corporate/about-us/management.

The Nominating and Corporate Governance Committee regularly reviews the size and composition of the full Board of Directors and considers the recommendations properly presented by qualified stockholders as well as recommendations from management, other directors and search firms to attract top candidates to serve on the Board of Directors. Except as may be required by rules promulgated by the SEC and the Nasdaq Capital Market, there are no specific, minimum qualifications that must be met by each candidate for the Board of Directors, nor are there specific qualities or skills that are necessary for one or more of the members of the Board of Directors to possess. In evaluating the qualifications of the candidates, the Nominating and Corporate Governance Committee considers many factors, including character, judgment, independence, expertise, length of service and other commitments, among others. The Nominating and Corporate Governance Committee does consider diversity when identifying director candidates and nominees with respect to differences of viewpoints, professional experiences, race, gender, and other individual qualities and attributes that contribute to heterogeneity on the Board. The Committee evaluates such factors and does not assign any particular weight or priority to any of these factors. While the Nominating and Corporate Governance Committee has not established specific minimum qualifications for director candidates, the Nominating and Corporate Governance Committee believes that candidates and nominees must reflect a Board of Directors that is predominantly independent and is comprised of directors who (i) are of high integrity, (ii) have qualifications that will effect a Reverse Stock Splitincrease the overall effectiveness of the Board of Directors, and (iii) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to Audit Committee members.

It is the policy of the Nominating and Corporate Governance Committee to consider recommendations for candidates to the Board of Directors from stockholders holding, continuously for at least one year prior to the date of the submission of the recommendation, either (i) shares of the outstanding sharesvoting securities of the Company in an amount equal to at least $2,000 in market value or (ii) 1% of the Company’s outstanding voting securities. Recommendations received after the date that is 120 days prior to the one year anniversary of the mailing of the previous year’s proxy statement, will likely not be considered timely for consideration at that year’s annual meeting. Stockholders may suggest qualified candidates for director by writing to the Nominating and Corporate Governance Committee, care of the Chief Financial Officer, 2220 Lundy Avenue, San Jose, California 95131 and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications and an explanation of the reasons why the stockholder believes the candidate is qualified for service on QuickLogic’s common stockBoard of Directors. The stockholder must also provide such other information about the candidate that would be required by the SEC rules to be included in a proxy statement. In addition, the stockholder must include the consent of the candidate and describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination. The Nominating and Corporate Governance Committee will evaluate all director nominations that are timely and properly submitted by stockholders on the same basis as any other candidate. Our Nominating and Corporate Governance Committee’s Policies and Procedures for Director Candidates is posted on our website at http://www.quicklogic.com/corporate/about-us/management.

During 2020, activities of the Nominating and Corporate Governance Committee included reviewing and approving any actual or potential conflicts of interest, assessing the structure and performance of the Board and the committees of the Board, and reviewing our Code of Conduct and Ethics and our Policy for Stockholder Communications with Directors. The Nominating and Corporate Governance Committee also assessed the independence and qualifications of our directors, reviewed the performance of the CEO and his assessment of our executive officers, and ensured our directors adhered to our Corporate Governance Guidelines, including reviewing, monitoring and, where appropriate, approving fundamental financial and business strategies and major corporate actions. A copy of the Code of Conduct and Ethics and a reverse stock split ratio ranging from 1-for-5 to 1-for-15, as determined bycopy of the Policy for Stockholder Communications with Directors are posted on our website at http://www.quicklogic.com/corporate/about-us/management.

Non-Standing Committees and Participation

The Board of Directors athas delegated to the Equity Incentive Committee, which in 2021 consisted of Brian C. Faith, our President and Chief Executive Officer and Suping (Sue) Cheung, our former Chief Financial Officer (who resigned as of February 17, 2021), the authority to: (i) approve the grant of options to purchase Company stock to employees other than executive officers and certain other individuals, up to a later date. Aslimit of 40,000 shares per option grant; (ii) approve the October 8, 2019 record date, 116,555,756 sharesaward of our commonrestricted stock were issuedunits (RSUs) based on dollar value maximums in accordance with guidelines established by the Committee, with inputs from Radford Consulting, up to a maximum dollar value of $100,000 for the top non-executive job level; (iii) grant refresh options or RSUs to employees other than executive officers and outstanding. Based on such number of shares of our common stock issued and outstanding, we’ve presented an example ofcertain other individuals, subject to the impact of a 1-for-10 reverse stock split on the issued and outstanding shares of stock and shares available for future issuance in the table under the caption “—Effects of the Reverse Stock Split—Effect on Shares of Common Stock”. The actual impact of the Reverse Stock Split will depend on the actual reverse stock split ratio determined by our Board of Directors.

The proposed amendment will not result in a reductionapproval of the total number of sharessuch refresh options or RSUs by the Board of Directors or the Compensation Committee; and (iv) amend options as authorized by the Board of Directors. Timothy Saxe replaced Ms. Cheung on the Equity Incentive Committee following her departure in February 17, 2021.

The Board of Directors held a total of five meetings and acted by unanimous written consent two times during 2021. During 2021, no incumbent director attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board of Directors held during his or her term as a director and (ii) the total number of meetings held by all committees of the Board of Directors on which such director served during his or her term on such committee.

QuickLogic expects its directors to attend its annual meetings absent a valid reason. All then-current directors attended the May 12, 2021 Annual Meeting of Stockholders.

Stockholder Communications with the Board of Directors

The Nominating and Corporate Governance Committee has established a policy for stockholder communication with our Board of Directors. This policy, which is available on the investor relations portion of our website, provides a process for stockholders to send communications to the Board of Directors. Stockholders may contact QuickLogic’s Board of Directors or any individual member thereof, by writing, whether by mail or express mail, to: QuickLogic Corporation Board of Directors, 2220 Lundy Avenue, San Jose, California 95131. Communications received in writing are reviewed internally by management and then distributed to the Chairman or other members of the Board, as appropriate. Stockholders who wish to contact the Board of Directors or any member of the Audit Committee to report questionable accounting or auditing matters may do so by using this address and designating the communication as “Compliance Confidential.”

Code of Conduct and Ethics

QuickLogic adopted a Code of Conduct and Ethics applicable to all directors, officers and employees on February 12, 2004. The Code of Conduct and Ethics covers topics including, but not limited to, financial reporting, conflicts of interest, confidentiality of information, compliance with laws and regulations and the code of ethics for our Chief Executive Officer, Chief Financial Officer and controllers. A copy of the Code of Conduct and Ethics, as amended, is posted on our website at http://www.quicklogic.com/corporate/management. To date, there have been no waivers under our Code of Conduct and Ethics. We will post any waivers, if and when granted, on our website at http://www.quicklogic.com/corporate/about-us/management.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2021, the following directors were members of QuickLogic’s common stock that QuickLogic is authorized to issue.Compensation Committee: Gary H. Tauss (Chairman), Michael R. Farese, Radhika Krishnan, Daniel A. Rabinovitsj, and Christine Russell. None of the Compensation Committee’s members has at any time been an officer or employee of QuickLogic.

All holdersNone of QuickLogic’s common stocknamed executive officers serve, or in the past fiscal year have served, as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving on QuickLogic’s Board or Compensation Committee and none have engaged in any transaction with related persons, promoters or certain control persons requiring disclosure under Item 404 of Regulation S-K.

APPROVAL OF AMENDMENT OF THE COMPANY'S 2019 STOCK PLAN

Summary